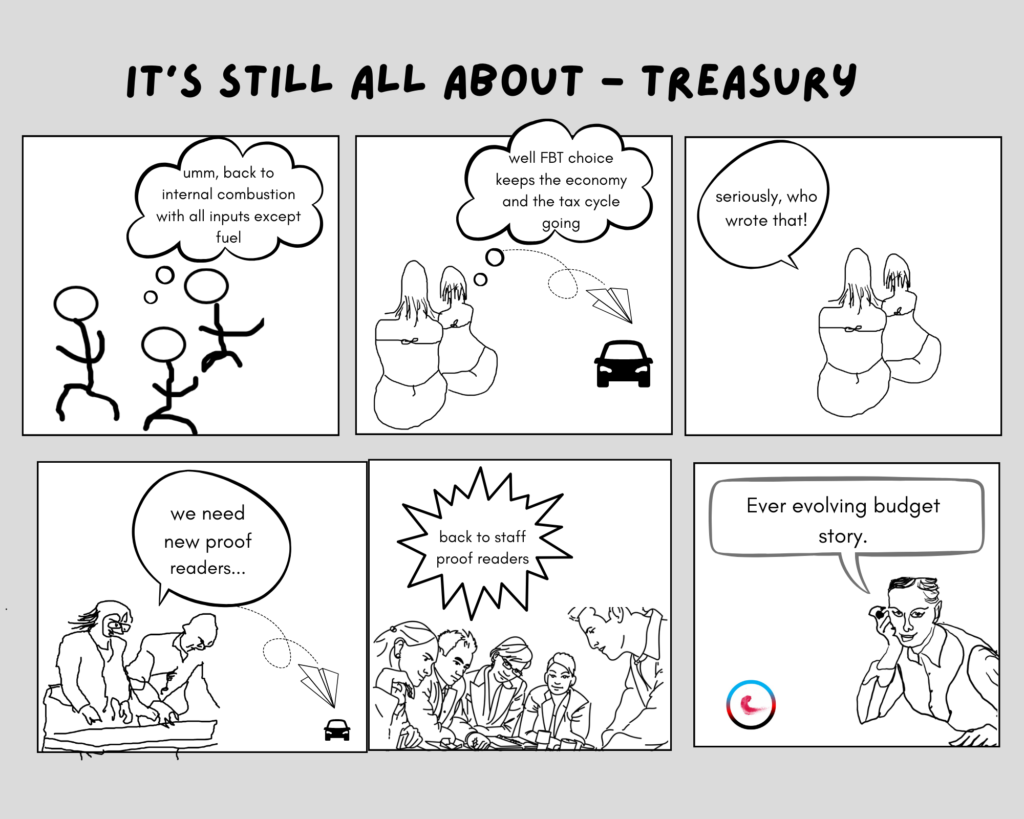

Episode 45 begins with reporting awareness of all the associated expenses and tests in the FBT exemption for electric vehicles.

Delivering news of FBT and tax exemptions that are eligible within a business can empower many readers of financial reports. At the highest level, FBT and tax exemptions are available to employees where the employer offers the ability to salary sacrifice through a novated lease program. This common practice among workers in not-for-profit, large or government business areas can lead to significant savings. Small businesses should consult a financial or taxation advisor to assess the possibilities and make informed decisions.

As always, the information in Illum’s is general in nature and does not constitute financial advice. Speaking to your employer or taxation professional is crucial to understand if a novated lease will work for you. The conversation will ensure you make confident and secure financial decisions.

“From 1 July 2022, employers do not pay FBT on eligible electric vehicles and associated car expenses”, the ATO explains on its webpage “Fringe benefits tax – Electric cars exemption” (QC71132).

The aim is to provide a financial incentive for employees to purchase electric cars under a salary sacrifice novated lease, thereby saving money on the business FBT bill.

However, it’s essential to know that the scheme only applies to plug-in hybrid vehicles until 31 March 2025. After this date, low emission is not available. Being aware of this limitation prepares you for future changes.

Are you enjoying our cartoons? Save time and grab some cheeky characters for your updates and newsletters here.

We hope you’re enjoying our The ESG Tickler jottings, just a note though. The information provided here is intended for general informational and educational purposes only. While we aim for accuracy, we can’t guarantee that this content will apply to your specific situation—everyone’s circumstances are unique.

The ESG Tickler is not a substitute for personalized advice from a qualified accountant, tax advisor, or any other professional. If you have questions specific to your individual circumstances, we strongly recommend consulting a professional for tailored advice.