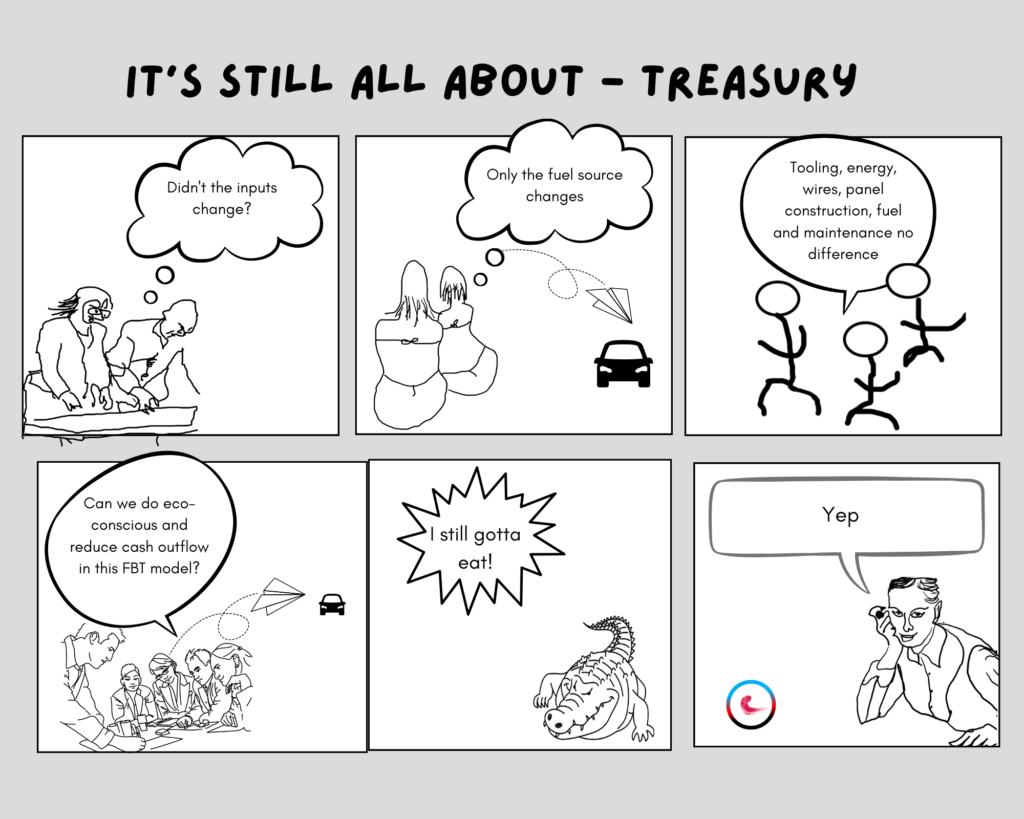

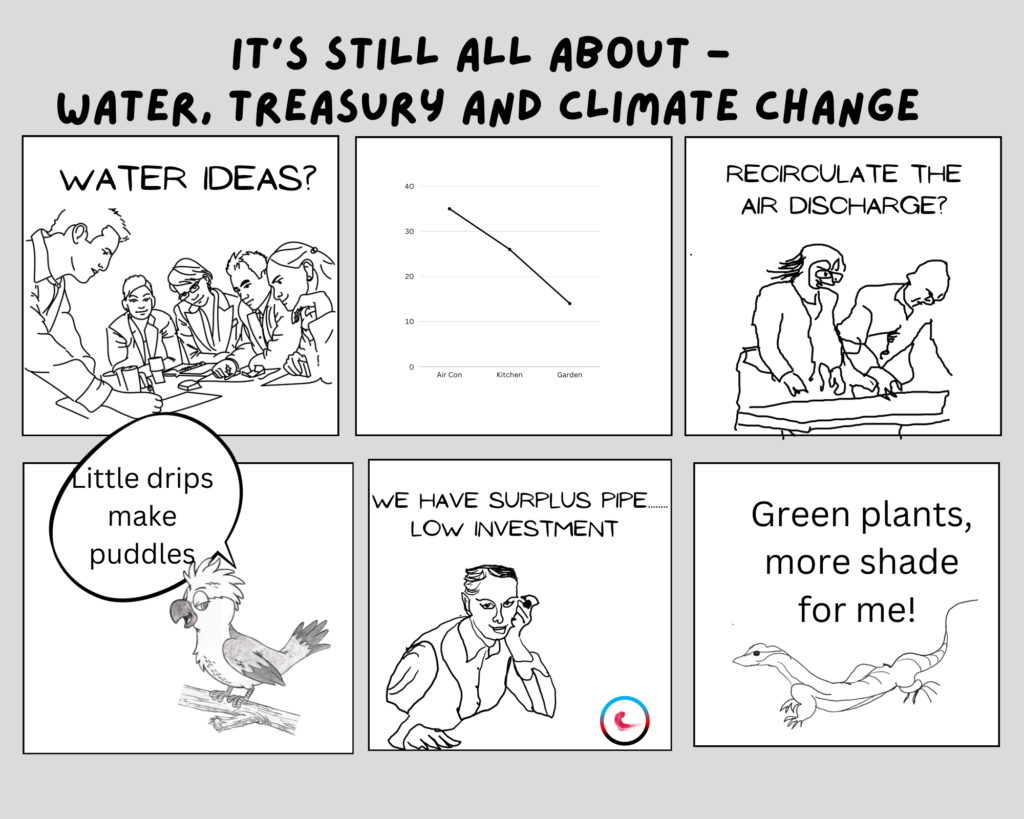

Budgeting for plastic and other cost savings and sustainability improvements is one of those challenges requiring careful examination and costing of all unintended outcomes.

It is easy to say we are going plastic-free and then grump when the cost of the replacements increases. Cause and effect accounting reviews the underlying production costs, which, of course, amongst other reasons, push up the purchase price.

Competing against cheap imports that receive subsidies is another market force affecting price budgeting since dawn itself. Some changes simply require a return to using base renewable materials that are quickly replaceable.

Collaboration between tasks enables realistic cost improvements, self-reliance and acceptance of diversity within understanding.

Are you enjoying our short cartoons? You can help us to pay it forward by grabbing yours to add a touch of irony or humour to your next toolbox or in-house sensitive or complex topic. We sourced ours from The Masked Comic.

We hope you’re enjoying our Illum jottings, just a note though. The information provided here is intended for general informational and educational purposes only. While we aim for accuracy, we can’t guarantee that this content will apply to your specific situation—everyone’s circumstances are unique.

Illum’s is not a substitute for personalized advice from a qualified accountant, tax advisor, or any other professional. If you have questions specific to your individual circumstances, we strongly recommend consulting a professional for tailored advice.