Process comfort is a business risk that applies across the ages. The hidden danger between following a tried and true, repetitive, and guaranteed outcome is boredom. A process itself is artificial when the process comfort is disrupted.

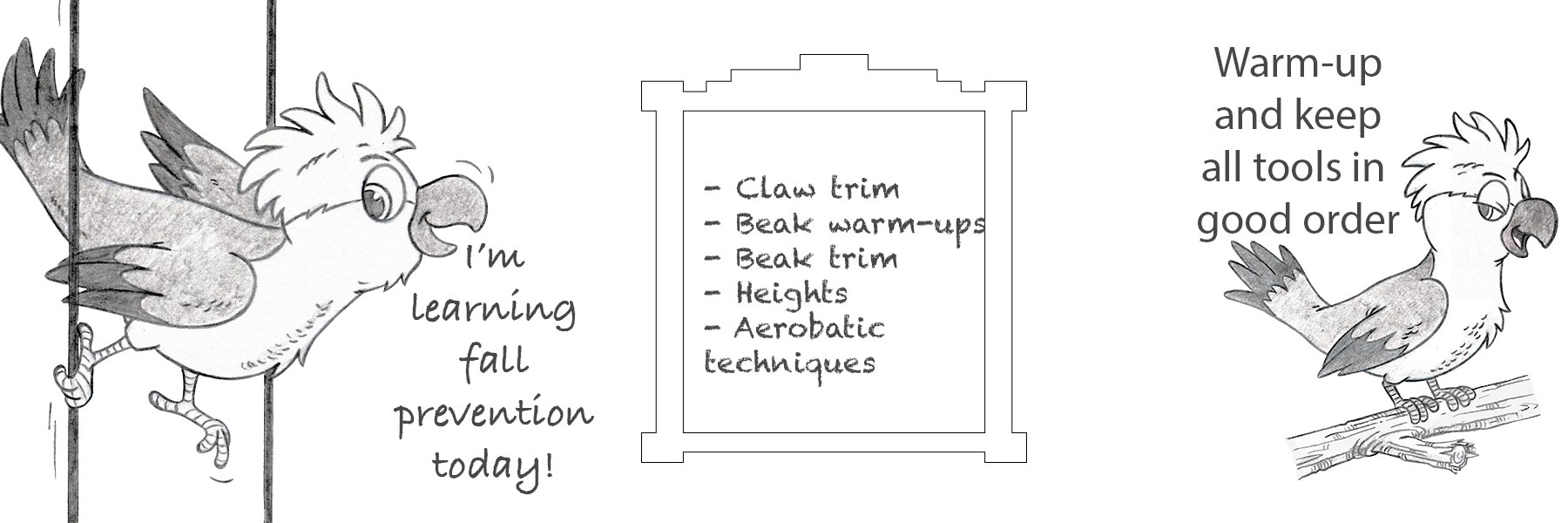

Whilst the cost of continual business watch can be expensive to recover in sales. All tools in all toolboxes at times need a little maintenance so they remain sharp.

Here is a short story from our business archives (*names and industry changed) where we took some time to have a chat to see if process boredom was presenting a danger in a profitable process comfort plan.

*Trevor stared at the process report sitting in his desk drawer. A few weeks earlier the company had commissioned a review. The focus looked at his processes not his results. It felt like a conversation, yet the probe raised some cash flow concerns. One in particular was a bit prickly. The work of the new analysts.

Over time he has carefully templated the process, reports, and ratios. He is a marketer who constantly plans to reduce the odds of surprises. Yet this unremarkable review had struck a nerve. The more repetitive work or work capable of automation had been implemented a long time ago. He already used experience and the testing for any diversions happening in his carefully planned structures. This review to him felt offensive, expensive, and unnecessary because of his carefully planned structures. Still the cascading ratio comment needed a reply. Turning his gaze towards his senior analyst, Trevor slid back the chair.

*Matteo worked as a *senior financial analyst. His team sought the next wave of investing interest, always hunting for above-market returns. His role analyzed changes in loan rates, stock prices, stock exchanges and other information. Matteo diligently followed Trevor’s arranged steps and patterns. To a large extent, the calculation formulae were preprogrammed into the software. He just needed to input the raw data.

Matteo thought back to his school days. Top or near the top of the class in any subject containing input or calculations, not needed now. His school days were irrelevant, he thought.

The coffee cup clattered loudly and hard on his desk. Trevor began talking to Matteo about the next task. It was necessary to make an inventory system for risk review. This system will help train new analysts and avoid mistakes when analyzing financial indicators. Matteo misheard the first sentence, rattled by the coffee cup.

It was an interesting and challenging task. Matteo systematized his experience in analyzing financial indicators and made a checklist. This checklist consisted of the main items that in his view, that had to be considered when interpreting the financial performance of companies and stock exchanges. After that, Matteo put this list in Excel and added some formulas to check the coefficients.

According to Matteo, the new system was almost finished and gave excellent results. It was necessary to test this system, and because Matteo’s colleagues considered him an excellent specialist and never questioned his assumptions about future quotes or forecasts. Matteo decided to implement it immediately. After all, everyone in his team wanted to achieve the same results as Matteo.

Colleagues began to test the system that Matteo sent them. Everyone was delighted as it produced ready-made references and results for many financial indicators. Matteo was pleased with his development and expected that making minor changes to the system would still be necessary.

A week after testing the system, Matteo still had no comments from his colleagues. As the weekend had arrived, Matteo decided to prepare a presentation after the weekend to present the approach to the Trevor.

Trevor generally liked this system, but he made a few comments. Firstly, the checklist included many items that needed to be checked only in some cases. Trevor also saw an error in the calculation of one coefficient. It was just a typo, but other indicators in their calculations relied on this result.

Trevor offered to test the program, and Matteo said that he had already done it and the new analysts had used it for a week with no comments.

Rolling back his eyes, Trevor thought it was unusual the work output had increased.

Trevor asked Matteo to explain the calculation of the erroneous coefficient to see if he recognized the error. Matteo answered correctly. Trevor again asked Matteo if he had seen the typo in his review. Matteo’s eyes opened wide, face reddening he responded yes, he knew. Nodding his head Trevor paused for a moment.

Trevor said that all analysis done with this error would need to be redone as it cascaded through the other process decision-making steps. Because new analysts need more experience to understand what is at stake fully. He went on to say to Matteo that to assume the newbies would correct the typo as they worked and not comment on it was wrong, although surprising that they had not. He went further to say that if Matteo had immediately showed him his system when complete, his colleagues would not have to redo a weeks’ worth of work now.

The error was costly both in rework expense and potentially income results to the company.

Matteo thanked Trevor for seeing the error and apologized for not getting a sign-off before it went into operation. As he walked away, Matteo thought he was only being innovative, and the process was too restrictive to work within.

Matteo thoughts wandered back to a school assignment as he grabbed his bag and headed off for the weekend. Calculations went well except for one year. The answers took a lot of work to reach. The steps to the answers were well known to him. It’s just the order that they needed to be processed was different. Matteo struggled with them. When he returned home, he noticed his older brother was back, and his brother had flung his bag on the bed, partially spilling the contents. One mathematics book caught his eye, and it had similar questions. Matteo’s eyes widened as he flicked through the book. The exact questions. Better still, in this book they had the answers. Matteo could not believe it. He steadfastly copied the answers to the first 5, then carefully closed the book and returned it to his brother’s bag.

Matteo took a while, but eventually, he figured out how the answer worked and completed the remaining questions quickly. He tired towards the end. In one question he had made a simple mistake at the beginning of the process—one which amplified all the way through and gave an incorrect answer. In the next class, the teacher provided an opportunity to review or do final corrections. Matteo decided not to correct it, as he thought the other answers, he had done were probably wrong.

He had missed out on a prize because of that process error. He thought he would never need to do calculations again. Yet here was the same process error, again.

As Matteo boarded the bus home, Trevor began completing the cascading ratio comment response and then a warning report to Matteo; this action had consequences that affected the business’s financial operation. It was a relief an informal yet outside set of eyes to review the processing steps had occurred. Although it was an irritation at the time. The Do2c report sat in his drawer, and here is one of the outcomes it highlighted. That report brushed broad knowledge poking through his specialized steps. It had held firm on a weakness. Trevor may have only noticed the results had weakened in the cash flow once damage occurred.

A Prov3-IT review not only unblocks workflow processes, it validates success. Marketing, research, inventory, distribution, treasury, and many others all are vital cogs.

Your digital connections are authentic, memorable, and seamless in your business. A touch of maintenance or an inspection strives to keep weaknesses away.

Engage maintenance today with a Do2c review.

Simply email or call us to arrange a meeting.