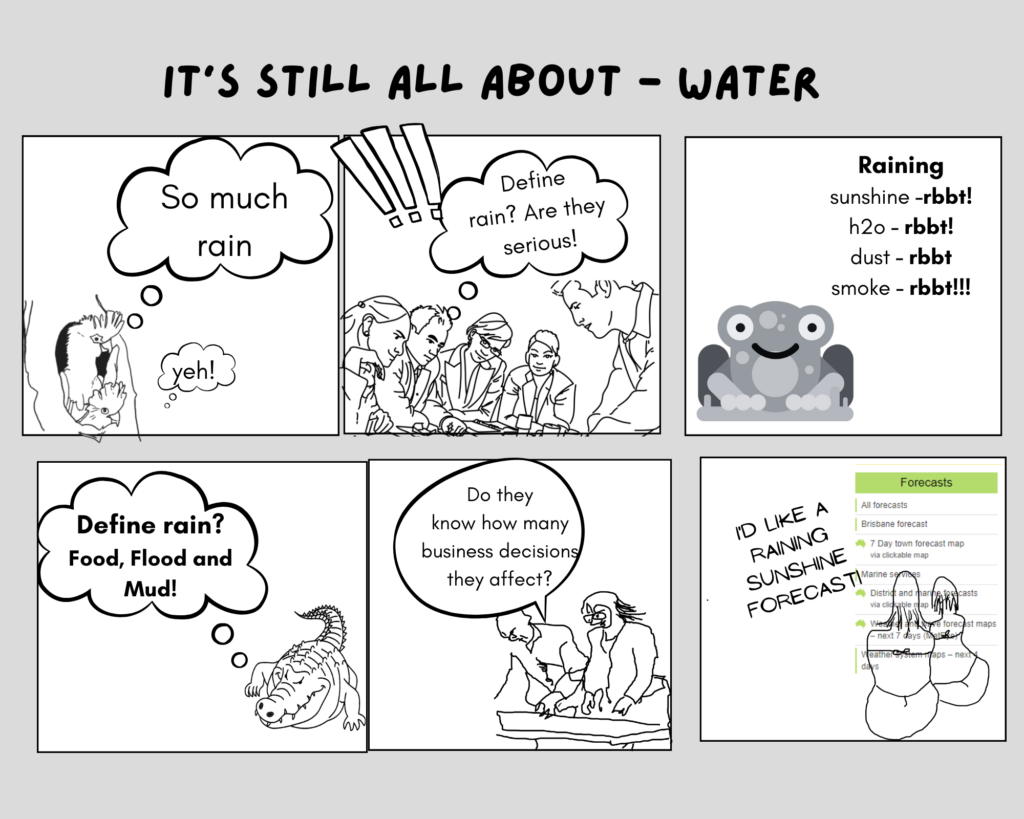

In episode 42, the team discuss business decisions and how best to manage poor inputs into major service. planning. Because within your business decision elements, every choice will produce results. What factor do you bring for the future?

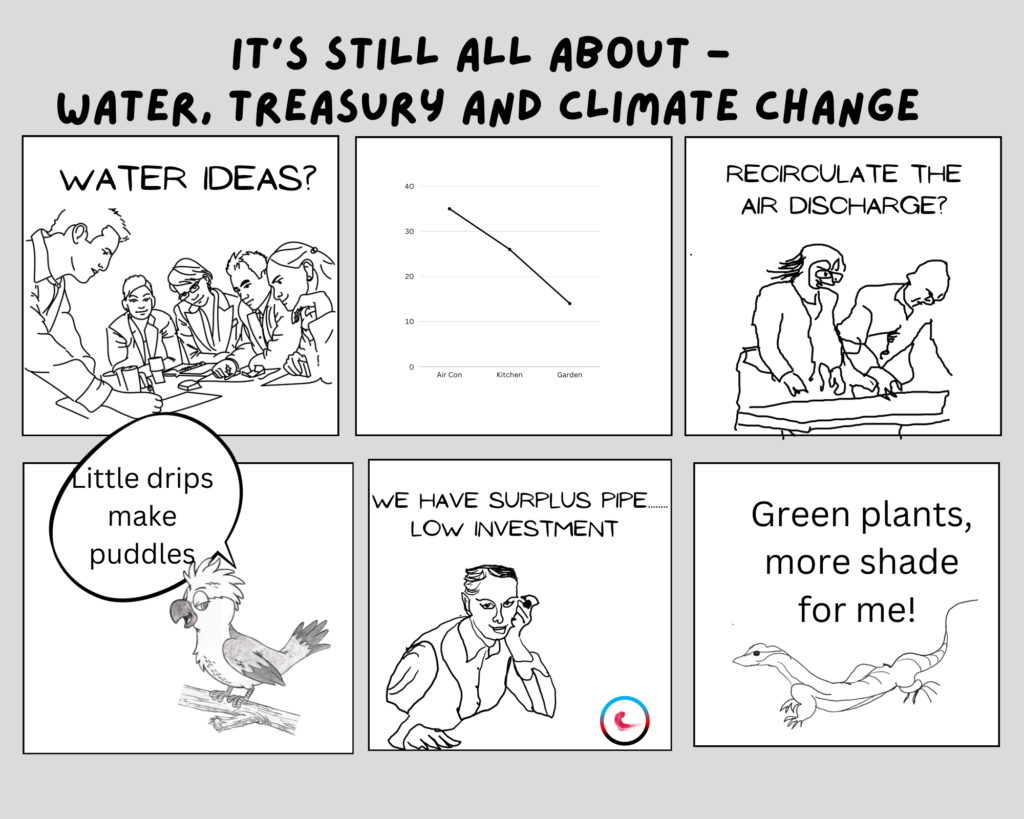

Whether it is the one that delivers true value to your business is the one that looks at how far it reaches across your goals. That reach may need definitions for boundary placement.

Predicting business decisions in advance

Whether (pun intended) or not your decision for your sales or new business plan forecast is likely to contribute to you reaching your goals is a careful evaluation.

Accounting is shaped by the consideration of many different views. So, take the time to review the downsides meaningfully.

Being close to the action helps forecasts. Why? The most powerful models render themselves useless when they ignore the eyes on the ground.

Accounting helps value symptoms and provides a guide to your root cause plans. Because when you reach out to your accountants; they will often help you identify the root cause.

Your forecasts affect many budgets, resource allocations, timeframes, quality and customer satisfaction. So, communicating your thoughts with the decisions and the substance and reasoning value will bring everyone up to a consistent level of understanding.

Are you enjoying our cartoons? Save time and grab some cheeky characters or easy to use blank formats for your updates and newsletters here.

We hope you’re enjoying our The ESG Tickler jottings, just a note though. The information provided here is intended for general informational and educational purposes only. While we aim for accuracy, we can’t guarantee that this content will apply to your specific situation—everyone’s circumstances are unique.

The ESG Tickler is not a substitute for personalized advice from a qualified accountant, tax advisor, or any other professional. If you have questions specific to your individual circumstances, we strongly recommend consulting a professional for tailored advice.