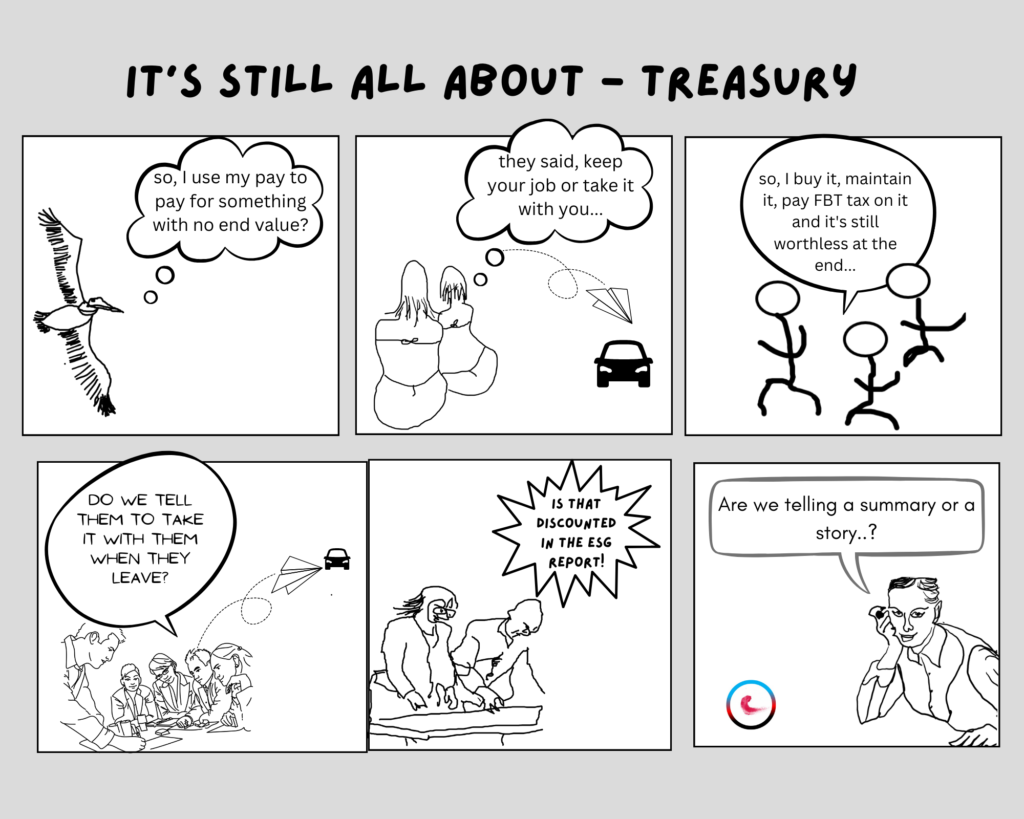

In episode 43, the FBT changes also include tests for purchase date and the right car engine to remain eligible for the exemption. Selection and resale are getting complicated.

FBT electric vehicle exemption has two tests. The exemption applies to a car benefit only if the earliest purchase date time when a person both held and used the car was at or after the start of 1 July 2022.

Source: para. 1:16 in the EM to the Treasury Laws Amendment (Electric Car Discount) Bill 2022 has an example of held and used after 1 July 2022.

If Zena acquires an electric car on 1 April 2022 and makes that car available for the private use of her employee Jack, to provide car fringe benefits from that date for four years. The benefits provided from 1 July 2022 will not be exempt. Additionally, if Zena were to instead sell the car to another employer after Jack had used it for two years (i.e. on 1 April 2024) the benefit that employer may provide to its employees for the use of the electric car will also not be exempt.

Also, electric vehicles and associated car expenses has a variation. A home charging station is not a car expense associated with providing a car fringe benefit for electric cars.

That home charging expense may need to be considered by the accountants as either a property fringe benefit or an expense payment fringe benefit. Other benefits of running the eligible car including benefits provided under a salary packaging arrangement are included in the exemption.

The ATO webpage ‘’Fringe benefits tax – Electric cars exemption ‘’ (QC71132) has more information.

Regeneration is our commitment.

Are you enjoying our cartoons? Save time and grab some cheeky characters for your updates and newsletters here.

We hope you’re enjoying our The ESG Tickler jottings, just a note though. The information provided here is intended for general informational and educational purposes only. While we aim for accuracy, we can’t guarantee that this content will apply to your specific situation—everyone’s circumstances are unique.

The ESG Tickler is not a substitute for personalized advice from a qualified accountant, tax advisor, or any other professional. If you have questions specific to your individual circumstances, we strongly recommend consulting a professional for tailored advice.