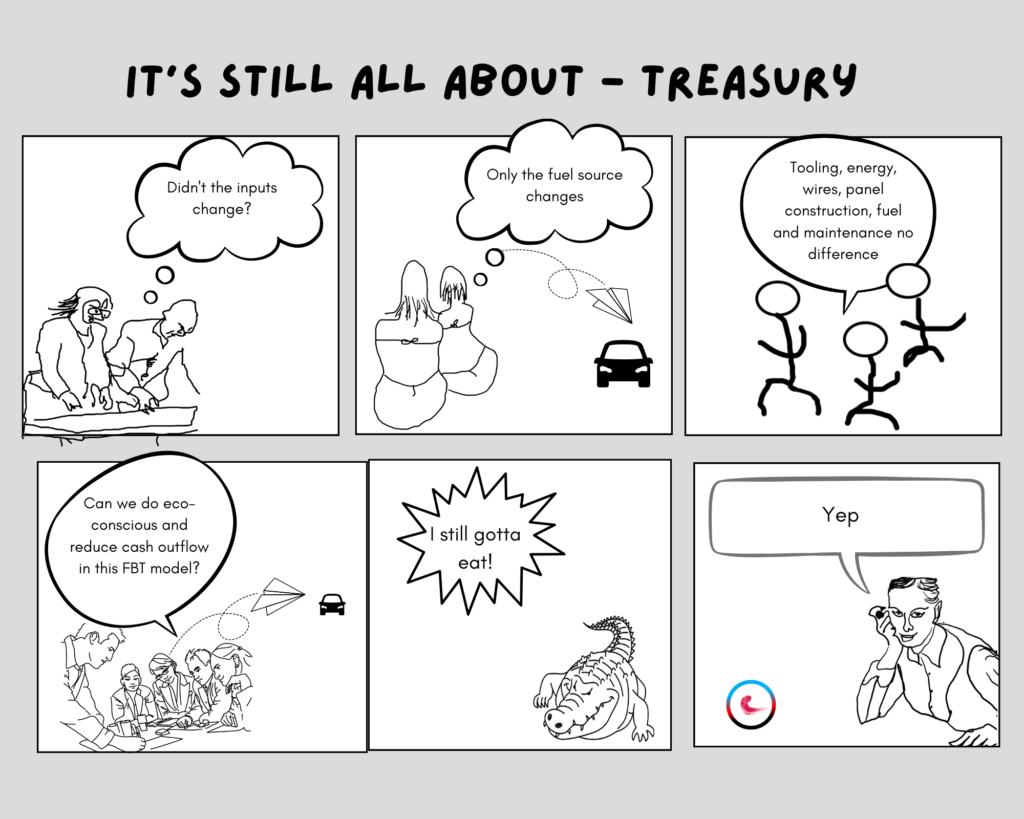

In episode 41, the upcoming FBT changes to electric vehicles begin to raise chatter. Many in the business are affected.

Electric vehicles are described as zero or low emissions vehicles. But what is the definition of a hybrid and how do those FBT changes affect existing salary packages?

What is a zero or low emissions vehicle? A zero or low emissions vehicle, which is eligible for the FBT exemption, is defined as:

(a) a battery electric vehicle, or

(b) a hydrogen fuel cell electric vehicle, or

(c) a plug-in hybrid electric vehicle and this exemption is to end 31 March 2025.

However, the exemption will continue to apply if the use of the vehicle was exempt before that date, and there is a financially binding commitment to continue providing private use of the vehicle from that date.

The objective of the exemption is to encourage a greater take up of electric cars.

Regeneration is our commitment.

Are you enjoying our cartoons? Save time and grab some cheeky characters for your updates and newsletters here.

We hope you’re enjoying our The ESG Tickler jottings, just a note though. The information provided here is intended for general informational and educational purposes only. While we aim for accuracy, we can’t guarantee that this content will apply to your specific situation—everyone’s circumstances are unique.

The ESG Tickler is not a substitute for personalized advice from a qualified accountant, tax advisor, or any other professional. If you have questions specific to your individual circumstances, we strongly recommend consulting a professional for tailored advice.